Gladstone Commercial Corporation

Public Non-Listed Senior Common Stock Offering

Dealer Manager: Gladstone Securities, LLC

Filed pursuant to Rule 433

Registration Statement No. 333-190931 |

Gladstone Commercial Corporation

Public Non-Listed Senior Common Stock Offering

Dealer Manager: Gladstone Securities, LLC

Filed pursuant to Rule 433

Registration Statement No. 333-190931 |

Forward-Looking Statements

This free writing prospectus has been prepared for informational

purposes

only from information supplied by Gladstone Commercial Corporation.

All statements contained in this free writing prospectus, other

than historical

facts, may constitute “forward-looking statements”

within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. Words such

as “anticipates,”

“expects,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates”

and variations of these words and other similar expressions are

intended to identify forward-looking statements. Readers

should not rely upon forward- looking statements because the

matters that they describe are subject to known and unknown

risks and uncertainties that could cause Gladstone Commercial

Corporation’s business, financial condition, liquidity,

results of operations, funds from operations or prospects to

differ materially from those expressed in or implied by such

statements. Such risks and uncertainties are disclosed under

the caption “Risk Factors” in the prospectus

supplement and the accompanying prospectus for the offering to

which this free writing prospectus relates, in Gladstone

Commercial Corporation’s most recent Annual Report on Form

10-K, in Gladstone Commercial Corporation’s Quarterly

Reports on Form 10-Q and in the other information that Gladstone

Commercial Corporation

files with the SEC. Other than as required by

applicable law, Gladstone Commercial Corporation shall have no

obligation or undertaking to update or revise any forward

looking statements to reflect any change in expectations,

results or events. 1 |

Free Writing Prospectus

Neither the Securities and Exchange Commission, or SEC, nor any state

securities commission has approved or disapproved of these

securities or passed upon the accuracy or the adequacy of this free

writing prospectus, the prospectus supplement or the accompanying

prospectus. Any representation to the contrary is a criminal

offense. This free writing prospectus only relates to the

securities of Gladstone Commercial Corporation described in the

prospectus supplement, dated September 24, 2013, as amended from time to time, and the

accompanying prospectus, dated September 24, 2013, that was included

in Gladstone Commercial Corporation’s registration

statement on Form S-3 (File No. 333-190931) which was filed with the SEC on

August 30, 2013. This free writing prospectus should be read in

conjunction with the prospectus supplement and the

accompanying prospectus. To view the prospectus supplement and

the accompanying prospectus which relate to this offering, click

the following link:

or

on

the

website that relates to this offering at

www.GladstoneCommercial.info. Gladstone Commercial

Corporation’s central index key on the SEC’s Web site is 0001234006.

Gladstone Commercial Corporation has filed a registration statement,

including a prospectus and a prospectus supplement, with the

SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus and the prospectus supplement

in that registration statement and other documents Gladstone

Commercial Corporation has filed with the SEC for more complete

information about Gladstone Commercial Corporation and this offering.

You may obtain these documents for

free

by

visiting

EDGAR

on

the

SEC

Web

site

at

www.sec.gov

or

by

clicking

on

the

links

above.

Alternatively,

Gladstone

Commercial

Corporation,

any

underwriter

or

any

dealer

participating

in

the

offering will arrange to send to you the prospectus and prospectus

supplement if you request it by contacting Gladstone

Securities, LLC, 1521 Westbranch Drive, Suite 100, McLean, VA 22102; Attention:

Investor Relations or by calling 1 (703) 287-5893.

2 |

Risk Factors

3

Risks Relating to Our Senior Common Stock and this Offering:

There is no established public trading market for shares of Senior

Common Stock, and we have no plans to list these shares on a

national securities exchange. We established the offering price

of shares of Senior Common Stock on an arbitrary basis, and, as a result, the actual value of

your investment may be substantially less than what you pay.

The calculation of the Exchange Ratio could result in a deterrent to

your exchanging shares of Senior Common Stock for shares of

Listed Common Stock if shares of Listed Common Stock are trading at lower levels at the time that you desire to

exchange your shares.

Your ability to redeem shares of Senior Common Stock pursuant to

our share redemption program is limited to the proceeds

generated by our distribution reinvestment plan, and the share

redemption program may be amended, suspended or terminated by

our Board at any time without stockholder approval. If you do

not agree with the decisions of our Board, then you will not be able to influence changes in our policies and

operations

because

holders

of

shares

of

Senior

Common

Stock

will

generally

have

no

voting

rights.

Our charter contains restrictions on the ownership and transfer of

shares of our capital stock, and these restrictions may inhibit

your ability to sell your shares of Senior Common Stock promptly, or

at all. Our Dealer Manager is one of our affiliates, and,

therefore, an investor in shares of Senior Common Stock would not have the

benefit of an independent underwriter who has performed an independent

due diligence review. Highly

leveraged

tenants

and

borrowers

may

be

unable

to

pay

rent

or

make

mortgage

payments,

which

could

adversely

affect

our cash available to make distributions to holders of our Senior

Common Stock. An investment in shares of Senior Common Stock involves substantial risks. You

should purchase our securities only if you can afford a complete loss of your

investment. Please read and consider the risk factors in the prospectus supplement and

prospectus before purchasing any securities. The most significant risk factors include: |

Risk Factors (continued)

Risks Relating to Our Company and Our Operations

Our business strategy relies heavily on external financing, which may

expose us to risks associated with leverage such as

restrictions on additional borrowing and payment of distributions to stockholders, risks

associated

with

balloon

payments,

and

risk

of

loss

of

our

equity

upon

foreclosure.

We are subject to certain risks associated with real estate ownership

and lending which could reduce the value of our investments,

including but not limited to, changes in the general economic climate; changes in

local conditions such as an oversupply of space or reduction in demand

for real estate; changes in interest rates and the availability

of financing; competition from other available space; and changes in laws and

governmental regulations, including those governing real estate usage,

zoning and taxes. Our

properties

may

be

subject

to

impairment

charges,

which

could

adversely

affect

our

results

of

operations.

Illiquidity

of

real

estate

investments

may

make

it

difficult

for

us

to

sell

properties

in

response

to

market

conditions

and

our

properties

may

include

special

use

and

single

or

multi-tenant

properties

that

may

be

difficult to sell or re-lease upon tenant defaults or early lease

terminations which could harm our financial condition and

ability to make distributions. Our

real

estate

investments

have

a

limited

number

of

tenants,

many

of

which

are

small-

and

medium-sized

businesses, and are concentrated in a limited number of industries,

which subjects us to an increased risk of significant

loss

if

any

one

of

these

tenants

is

unable

to

pay

or

if

particular

industries

experience

downturns.

4 |

Risk Factors (continued)

Risks

Relating

to

Our

Company

and

Our

Operations

(continued

from

previous

slide)

We may be unable to renew leases, lease vacant space or re-lease

space as leases expire, which could adversely affect our

business and our ability to make distributions to our stockholders.

We

may

enter

into

sale-leaseback

transactions,

whereby

we

would

purchase

a

property

and

then

lease

the

same

property

back

to

the

person

from

whom

we

purchased

it.

If

a

sale-leaseback

transaction

is

re-

characterized in a tenant’s bankruptcy proceeding, our financial

condition could be adversely affected. We are dependent upon

our key management personnel, who are employed by our Adviser, for our future

success, particularly David Gladstone, Terry Lee Brubaker, and Robert

Cutlip. Our

success

depends

on

the

performance

of

our

Adviser

and

if

our

Adviser

makes

inadvisable

investment

or management decisions, our operations could be materially adversely

impacted. We may have conflicts of interest with our Adviser

and other affiliates, including but not limited to the

following conflicts: (i) our Adviser may realize substantial

compensation on account of its activities on our behalf,

and

may,

therefore,

be

motivated

to

approve

acquisitions

solely

on

the

basis

of

increasing

compensation to itself; (ii) we may experience competition with our

affiliates for financing transactions; (iii) our Adviser may

earn fee income from our borrowers or tenants; and (iv) our Adviser and other

affiliates could compete for the time and services of our officers and

directors. If

we

fail

to

qualify

as

a

REIT,

our

operations

and

dividends

to

stockholders

would

be

adversely

impacted.

To the extent that our distributions represent a return of capital for

tax purposes, you could recognize an increased capital gain

upon a subsequent sale of your stock. 5 |

Offering Summary: Senior Common Stock

6

Issuer:

Gladstone Commercial Corporation

Current Status:

A

public reporting company with 17,715,958 shares

of Listed Common Stock outstanding (symbol:

GOOD) Security Offered:

Senior Common Stock (registered, non-listed)

Distribution Preference:

Distribution payments have a senior preference over

Listed Common Stock but are subordinate to

Preferred Stock

Distribution Rate:

$1.05 per share per annum, declared daily and

paid at the rate of $0.0875 per share per month

Please note: distributions are not guaranteed

Offer Price:

$15 per share

Shares Offered:

3,000,000 shares in primary offering and 500,000

shares pursuant to distribution reinvestment plan

Minimum Purchase:

200 shares having an aggregate minimum purchase

price of $3,000

The information on this page is accurate as of August 8, 2014. Past

performance is not indicative of future results. |

Offering Summary: Senior Common Stock (continued)

Initial Liquidity:

Non-listed, but with limited liquidity through

share redemption program based upon cash

proceeds generated by distribution

reinvestment plan

Conversion Liquidity:

Holders of Senior Common Stock have the right to

convert into shares of Listed Common Stock five

years after the date on which shares of Senior

Common Stock were originally purchased

Conversion Ratio:

Purchase price ($15.00) divided by the

greatest of:

(i) the closing trading price of Listed Common

Stock on the date on which shares of Senior

Common Stock were originally issued,

(ii) the book value per share of the Listed

Common Stock as determined as of the date on

which shares of Senior Common Stock were

originally issued, or

(iii) $13.68

7 |

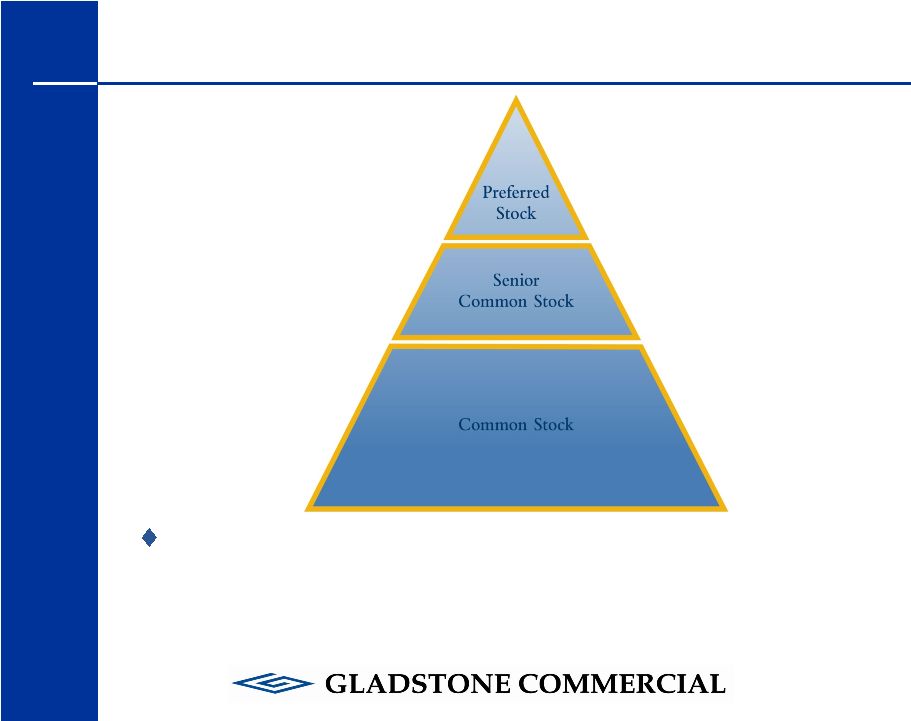

The Importance of Being Senior to Listed Common

Please Note: Distributions on Senior Common Stock have preference

over those paid on Listed Common Stock, but are subordinate to

those paid on existing and future series of Preferred

Stock 8 |

Additional Information

Annual

distributions

to

be

paid

on

3

million

shares

of

Senior

Common

Stock

would be $3.15 million

Total distributions paid to Listed Common Stockholders for the year

ended December 31, 2013 were $19.7 million

The

distribution

on

the

Listed

Common

Stock

was

$0.125

per

month

or

$1.50

for

the last 12 months

Cumulative: Distributions paid on shares of Senior Common Stock cannot

be decreased and are cumulative

Successful track record of not reducing distributions on Listed Common

Stock since inception in 2003

Please note: distributions are not guaranteed

Valuation: The value of shares of Senior Common Stock will be published

every quarter beginning with the quarter ending September 30,

2014 Not Callable: Shares of Senior Common Stock are generally not

callable prior to September 1, 2017

The information on this page is accurate as of August 8, 2014. Past

performance is not indicative of future results. 9

|

Fees & Expenses

If Gladstone Commercial sells 3,000,000 shares of the Senior Common

Stock in the primary offering, 11% of the proceeds will be used

to pay sales commissions, dealer manager fees, and other

offering expenses Gladstone Commercial pays its affiliated

investment adviser, Gladstone Management Corporation:

—

(i) an advisory fee of 2% of total stockholders’

equity less the value of

any preferred shares, and

—

(ii) a performance-based incentive fee

10 |

What kind of REIT is Gladstone Commercial?

Gladstone Commercial is a publicly-traded equity REIT incorporated

in 2003 to purchase

commercial

and

industrial

properties

that

are

leased

to

tenants

pursuant

to

triple

net

leases

(e.g.,

the

tenant

pays

taxes,

insurance

and

maintenance)

Gladstone Commercial files annual and quarterly reports, proxy

statements and other information with the SEC, issues press

releases, conducts quarterly earnings calls with stockholders and

has a full-scale investor relations department that utilizes

a publicly-available investor relations website Owns 93

properties in the US: —

purchase price was $826 million

—

geographically diversified in 23 states

—

diversified by property type in 17 distinct tenant industries

—

diversified by 80 different tenants

—

97% occupied and paying as agreed

The information on this page is accurate as of August 8, 2014.

Past performance is not indicative of future results. 11

|

Executive Management Team

12

Disclaimer: Past performance is not an indication of future

performance Bob Cutlip, President

Terry Brubaker, Chief Operating Officer

Over 25 years of experience investing in mid-sized and small

private businesses Current Chairman and CEO of all four

Gladstone funds, public companies #7, #8, #9 and #10 in his career

Former Chairman of Allied Capital Commercial (REIT) and Allied Capital

and American Capital when they were successful

Former board member of Capital Automotive REIT

MBA from Harvard Business School, MA from American University, BA from

University of Virginia Over 25 years commercial real estate

operations experience Former Managing Director at Sealy &

Company, LLC, where he led the Southeast & Mid Atlantic operations

for a vertically integrated real estate operating company

Former EVP of First Industrial Realty Trust where he directed the

acquisition and development business activities in 26 markets in

North America Former Regional EVP of Duke-Weeks Realty,

responsible for development, acquisitions and operations of the

Mid-Atlantic region Former National Chairman of National

Association of Industrial and Office Properties MBA from

University of Southern California, MS in Civil Engineering from Vanderbilt University, BA in Civil

Engineering from U.S. Air Force Academy

Over 25 years of experience in managing businesses

Currently COO and head of portfolio management for all four Gladstone

public funds Previously on the acquisition team of James River

Corp., as it grew from $200 million to $7 billion in revenues

Former group VP of two operating divisions at James River with 2,300

employees, $440 million in revenue and 14 locations

After

James

River,

was

CEO

of

two

businesses

with

800

employees,

$250

million

in

revenue

and

4

locations

Former consultant with McKinsey & Company

MBA from Harvard Business School; BSE in Aeronautical Engineering from

Princeton University David Gladstone, Chairman and CEO

|

Senior GOOD Leadership Team

13

Matt Tucker, Managing Director, Northeast and Midwest Regions

Buzz Cooper, Senior Managing Director, South and Southeast Regions

Andrew White, Managing Director, Western Region

More than 60 professionals as part of the Gladstone Team

Disclaimer: Past performance is not an indication of future

performance Manages regional acquisition and asset management

activities; joined Gladstone in August of 2013 Over 25

years of experience of real estate investing experience Formerly

held senior positions with MetLife Real Estate Investments, ING Realty Partners, Berwind

Property Group and MIG Real Estate

Manages regional acquisition and asset management activities; over 12

years with Gladstone Over 25 years of real estate investing

experience Former principal of Allied Commercial Corporation

REIT, where his responsibilities ranged from buying loans from

RTC and banks to making real estate backed loans Manages

regional acquisition and asset management activities; over 9 years with Gladstone

Over 15 years experience of real estate investing experience

Formerly held investment and advisory positions with Liquid Realty

Partners, SG Capital Partners and Chase Securities Inc.

|

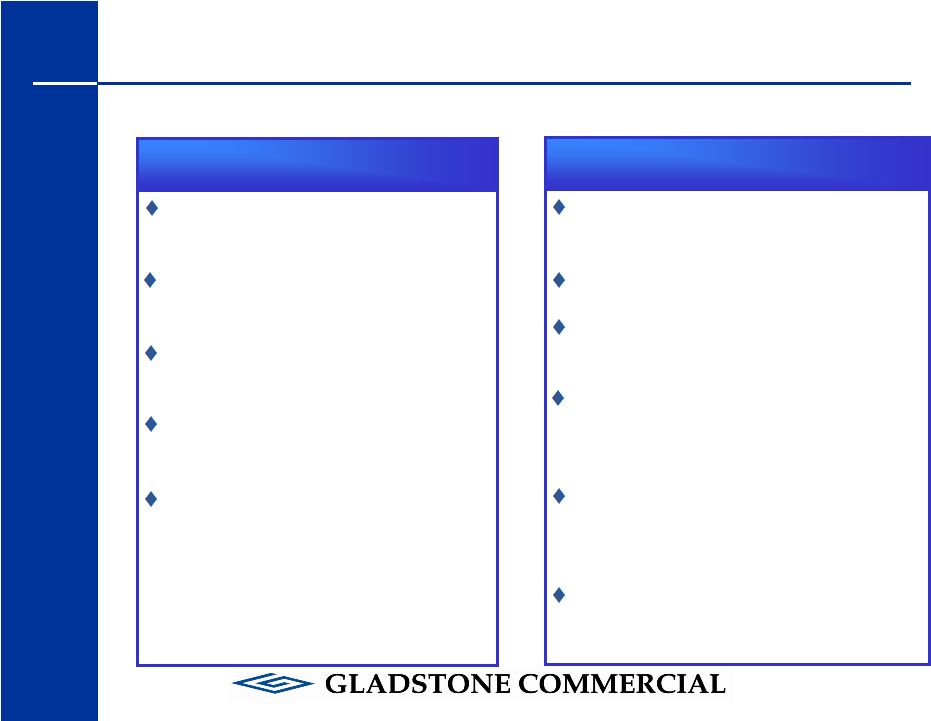

Dual Focus on Tenant and Real Estate Underwriting

14

Conduct an MAI Appraisal on each

property

Site visit to review property

Survey brokers in the area to verify

the value of similar properties

Phase I or II environmental report

and sometimes purchase

environmental liability insurance

Conduct a Property Assessment to

assure the building is structurally

sound

Zoning and title report to assure that

there are no deed problems

Due Diligence on the Real Estate

Detailed underwriting of the

tenant’s business

Review tenant’s financial

statements and projections

Prove out the cash flow of the

tenant’s business

Evaluate the management of the

tenant’s business

Determine the tenant’s risk rating

and the probability of default

using a proprietary tenant risk

rating system

Due Diligence on the Tenant |

Investment Strategy

15

National operation: Expanding across the U.S. for opportunities and

diversification Key

real

estate:

Own

properties

that

are

key

to

the

tenants’

operations

and

that

have favorable configuration and location traits

Middle market tenants: Use the Gladstone team’s credit methods to

underwrite middle market tenants to achieve better than market

returns Investment Criteria:

•

Transaction

Size:

$5MM

-

$50MM

•

Property Type: Single tenant and anchored multi-tenant

industrial, office and medical properties

•

Transaction Type: Third party acquisition, sale-leaseback,

build-to-suit JV, build-to-suit forward

purchase •

Lease Terms: NNN; term of 7+ years

•

Location: Strong markets in the path of growth

Disclaimer: Past performance is not an indication of future

performance |

16

Geographic Diversity of Gladstone Commercial’s Properties

The information on this page is accurate as of August 8, 2014.

|

Gladstone Commercial’s Focus on Certain Industries

Areas Where Opportunities Exist to Own Properties

•

Light manufacturing

•

Manufacturing of small products (plastic closures, disposable

tableware) •

Specialty manufacturing

•

Special purpose buildings with a conditional use permit (paper

manufacturing, commercial bakery)

•

Established software companies

•

With large amount of computer equipment (data center)

•

Offices

•

Headquarter or regional offices of the business (electronics,

telecommunications) •

Business services

•

Service companies with logistic services (consumer products)

•

Medical services/Healthcare

•

Buildings used to deliver medical services (medical practice)

•

Warehouses

•

Logistics operations or distribution centers with long-term

leases •

Specialty retailing

•

Special purpose retail outlets (drug stores)

17 |

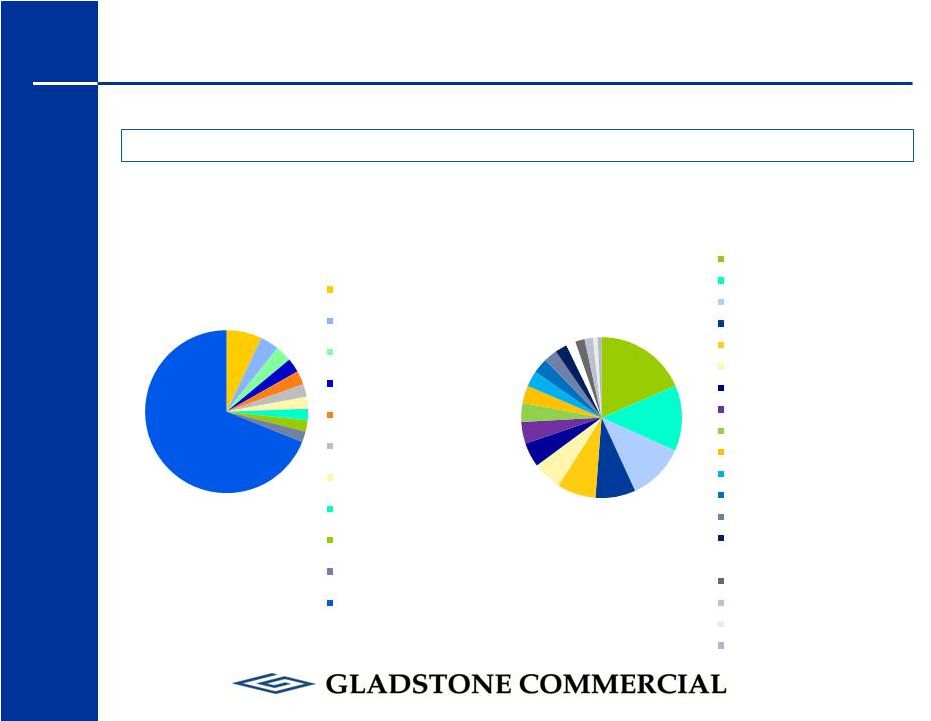

18

Tenant Mix

(as a % of Total Rent)

Tenant Industry Mix

(as a % of Total Rent)

No significant concentration in any tenant or in any industry.

Highly Diversified Tenant Mix

Disclaimer: Past performance is not an indication of future

performance As of 8/8/14

Company A -

7%

Company B -

4%

Company C -

3%

Company D -

3%

Company E -

3%

Company F -

3%

Company G -

2%

Company H -

2%

Company I -

2%

Company J

-

2%

All remaining tenants -

69%

Telecommunications -

19%

Automobile -

13%

Healthcare, Education & Childcare -

11%

Electronics -

8%

Personal, Food & Miscellaneous Services -

8%

Diversified/Conglomerate Manufacturing -

6%

Chemicals, Plastics & Rubber -

5%

Beverage, Food & Tobacco -

4%

Personal & Non-Durable Consumer Products -

4%

Machinery -

4%

Buildings and Real Estate -

3%

Containers, Packaging & Glass -

3%

Printing & Publishing -

3%

Diversified/Conglomerate Services -

2%

Childcare -

2%

Oil & Gas -

2%

Banking -

2%

Education -

1%

Home & Office Furnishings -

1% |

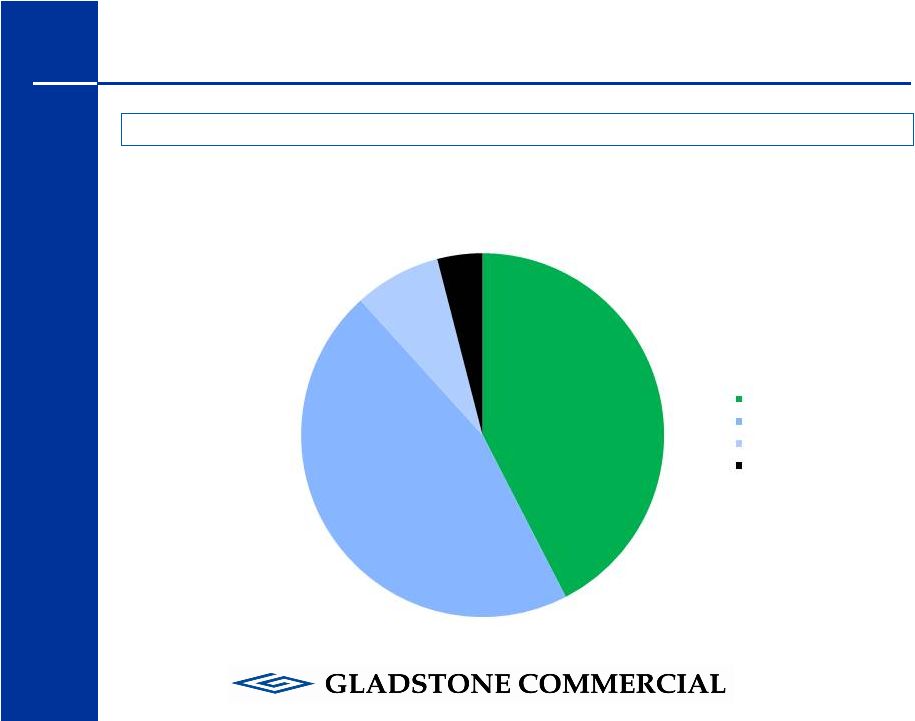

Target Asset Mix –

46% Office / 42% Industrial

19

Current Portfolio Mix

(as a % of Total Rent)

Office and industrial buildings touch most industries in the US and

facilitate diversification. Disclaimer: Past performance is not an

indication of future performance As of 6/30/14

42%

46%

8%

4%

Industrial

Office

Medical Office

Retail |

Select Properties

General Motors Company

$57.0MM transaction

One of the 4 nationwide new Innovation Centers

320,000 SF office building in the Austin Technology Corridor

Debt upgraded to investment grade following the purchase

ViaSat, Inc.

$18.0MM transaction

A $1.3BN supplier of space and mobile communications systems for

commercial and defense users

Mission critical 100,000 SF facility including Network Operations

Center

Located in the Denver Inverness Office Park

20

Disclaimer: Past performance is not an indication of future

performance |

Select Properties

Lear Corporation

$3.4MM transaction

170,000 SF manufacturing and distribution center

Forward purchase of a build-to-suit project

Less than one mile from Mercedes-Benz 3.7MM SF auto

assembly plant in Vance, Alabama

PTC Inc.

$14.4MM transaction

$1.3BN software supplier to the supply chain industry

92,000 SF mission critical R&D and data center facility

Located in the Minneapolis Lexington Preserve Business

Park

21

Disclaimer: Past performance is not an indication of future

performance |

Highlights

•

Strong Growth Profile Over 24 Months

–

48% Increase in Total Assets

–

50% Increase in Total FFO

–

64% Increase in Total Common Market Capitalization

•

Strong Historic and Current Returns

–

Since 2009, Exceeded the cumulative FTSE NAREIT Office/Industrial Index

by 53%

•

Excellent Shareholder–Aligned Team Performance

–

Remained 97% Occupied, Rent-Paying Through the Recent

Recession –

Never Lowered the Dividend nor Missed a Payment

–

Tenured

Core

Leadership

Team

Delivering

Consistent,

High

Quality

Results

22

Disclaimer: Past performance is not an indication of future

performance |

Senior Common Stock Highlights

7%

Annual

Yield:

Distribution

rate

of

$1.05

per

share

per

annum

Monthly

Distributions:

Paid

at

the

rate

of

$0.0875

per

share

per

month

Please note: distributions are not guaranteed

Distribution

Preference:

Distribution

payment

preference

over

Listed

Common

Stock

but

subordinate

to

existing

and

future

series

of

Preferred

Stock

Assets

in

Place:

Company

has

rent

paying

buildings

in

place

Experienced

Management:

More

than

50

people

on

management

team

Conversion

Liquidity:

Holders

of

Senior

Common

Stock

have

the

option

to

convert

into shares of Listed Common Stock after five-years

Conditional

Liquidity:

Quarterly

repurchase

of

shares

of

Senior

Common

Stock

limited by cash proceeds generated by the reinvestment plan

Valuation:

The

value

of

shares

of

Senior

Common

Stock

will

be

published

every

quarter beginning with the quarter ending September 30, 2014

23 |